A key Internal Revenue Service advisory committee has issued its recommendations for 2023, in an effort to keep the IRS – and Congress – on point with improvements to the nation’s income tax filing system.

The Electronic Tax Administration Advisory Committee (ETAAC) is chaired by Jared Ballew, Vice President of Government Relations at Taxwell Representing Drake Software and TaxAct. ETAAC’s just-released annual report carries 26 recommendations aimed at improving electronic tax filing.

Of the 26 items on the committee’s action list, 21 are aimed at the IRS, three are addressed to both the IRS and Congress, and two are meant for Congress.

Some of the 2023 recommendations have their roots in previous ETAAC reports, such as the appeals to Congress to provide timely tax legislation and to pass consistent funding packages for IRS operations and administration.

Other recommendations, meanwhile, look to the future, asking the IRS to make modernization of their processes and equipment a priority, along with improving its online search engines.

Some of the remaining recommendations include:

- Making the IRS’ expansion of the Online Account toolset a priority.

- Prioritizing e-filing of 94X returns and improving processing of duplicate 94X returns.

- Updating Form 1099-K (and its education materials) to allow for easy compliance.

- Making tax information documents available digitally in real-time, so taxpayers can easily export tax data into third-party software.

- Speeding up processing of returns, whether electronically filed or paper.

- Asking the IRS and Congress to do more to regulate paid tax preparers and take steps in the areas of incompetent or unscrupulous conduct.

- Stressing the IRS should come up with ways to deal with higher attrition of its workforce and increasing demands for customer service.

- Asking the IRS to provide timely guidance on federal and state laws that can have an impact on tax administration.

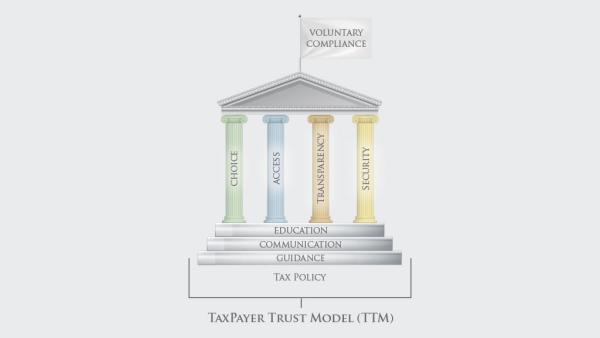

An introductory letter in ETAAC’s 84-page Report to Congress says the committee worked hard to present a report that was balanced yet comprehensive. It uses what the committee calls “the taxpayer’s journey” to describe the various facets of the income tax process. ETAAC also developed a new model to aid in decision-making processes for both policymakers and tax administrators.

“ETAAC has established the Taxpayer Trust Model (TTM) in an effort to standardize, build and maintain high levels of trust in the tax system and to increase compliance. We believe the TTM framework can serve legislators, tax administrators, and stakeholders in their decision-making processes.”

The report also notes that a number of recommendations made in the committee’s previous 2022 report remain unrealized and are still in need of action from the IRS as well as Congress.

The members of ETAAC come from sectors throughout the tax community, representing individual and business taxpayers, tax professionals and preparers, tax software developers, providers of payroll services, the financial industry and state and local governments.

The committee frequently works with the Security Summit, which is a panel made up of IRS officials, state taxing agency representatives and tax industry partners all working together to fight tax-related identity theft and other cybercrimes.